To enable Third Party Management on SPS, the “Use third party management” parameter must be activated for the creditor entity in the Organizations Management module. A third party database will be created to help filling mandates. It can be updated through a third party management file, or by creating/editing a third party using the web services or the GUI.

When the database is activated, it is considered as a master database in relation to the mandate database: editing a third party will affect all the related mandates, while modifying a mandate will not have any consequence in the third party database.

Should the parameter not be activated, the user will be warned while accessing the Third Party Management module.

The module is available from Home > Creditor > Third-party Management > Third-party search.

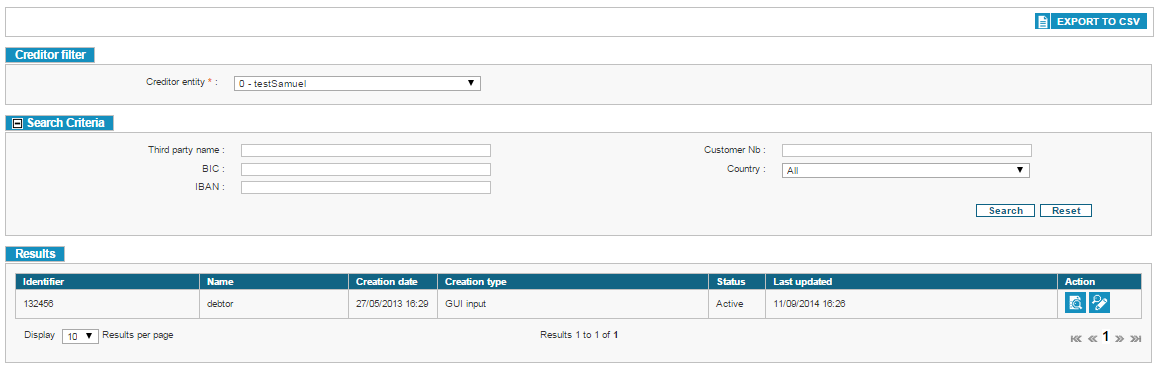

Searching for a Third Party

By browsing to Home > Creditor > Third Party Management: Third Party Search, the user will be able to lookup a third party.

A third party is linked to the root of the organization. Searches can be run from a name, a bank account or a customer reference.

The results table gives the following data:

-

Third party identifier;

-

Third party’s name;

-

The date the third party was added to the database;

-

The date the third party was last modified;

-

How the third party was added to the database (from a file or the GUI).

-

The status of the third-party

Accessing the third party’s details is possible from the results table.

A delete button is visible for each third party if all of the third party’s mandates have a “Finalized”, “Revoked” or “Obsolete” status, or if the third party has no associated mandates.

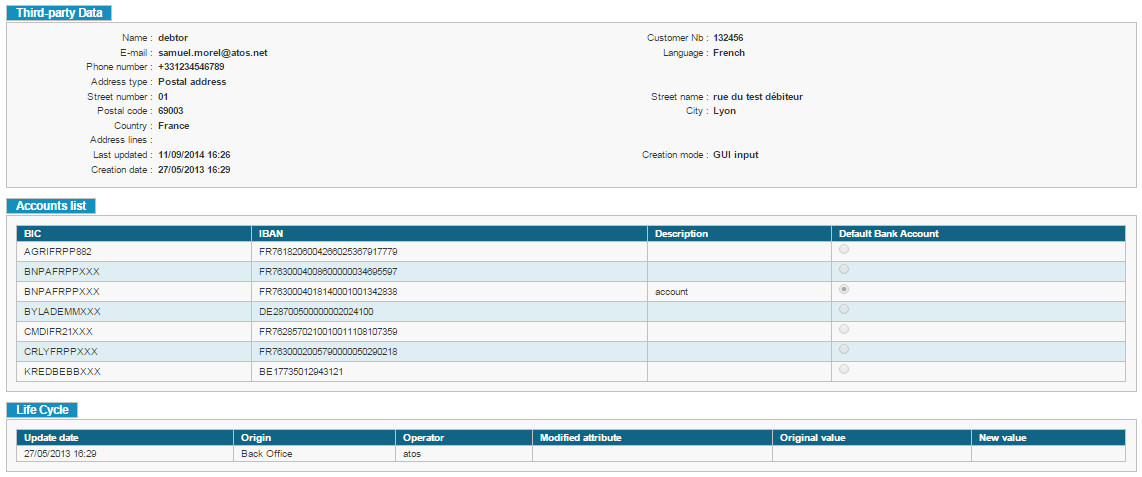

Viewing a Third Party

From the search page, hitting [See Details] will redirect the user to the third party’s page.

This page is split into three blocks:

-

The “Third party data” block. Are available:

-

The third party’s name;

-

His customer number;

-

Address;

-

Phone number;

-

Creation and update dates;

-

Creation and update modes;

-

Number of associated SDDs and mandates.

-

E-mail

-

Language

-

Creation mode

-

-

The “Accounts list” block:

-

BIC and IBAN of the account;

-

A description of the account.

-

Default Bank account indicator

-

-

The “Life Cycle” block:

-

Update date(s);

-

Origin and identity of the user that updated the third party’s account;

-

The edited field;

-

Its former and current values.

-

Operator

-

From this page, the user also has access to a number of actions.

Hitting [Back] will take the user back to the third party search page. The [Edit Third Party] button allows the modification of the third party’s info and bank accounts. The [Delete] action removes the third party; however the action is only possible if all of the third party’s mandates have a “Finalized”, “Revoked” or “Obsolete” status, or if the third party has no associated mandates. The [View Associated Mandates] buttons displays the list of mandates linked to this third party.

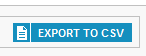

Exporting the Third Parties to a CSV File

Clicking the [Export to CSV] button will create a CSV file containing the following data:

-

Third party’s name;

-

Third party’s BIC and IBAN;

-

Third party’s identifier;

-

Phone number;

-

Address;

-

Third party’s email address;

-

Creation date;

-

Third party language;

-

Number of associated mandates.

The maximum number of third parties exported in the file is limited to 100001.

But if the number of third parties to export is more than 100001, then an error message is displayed.

If the user clicks on [EXPORT TO CSV] button again while previous export is still in process then error message is displayed.

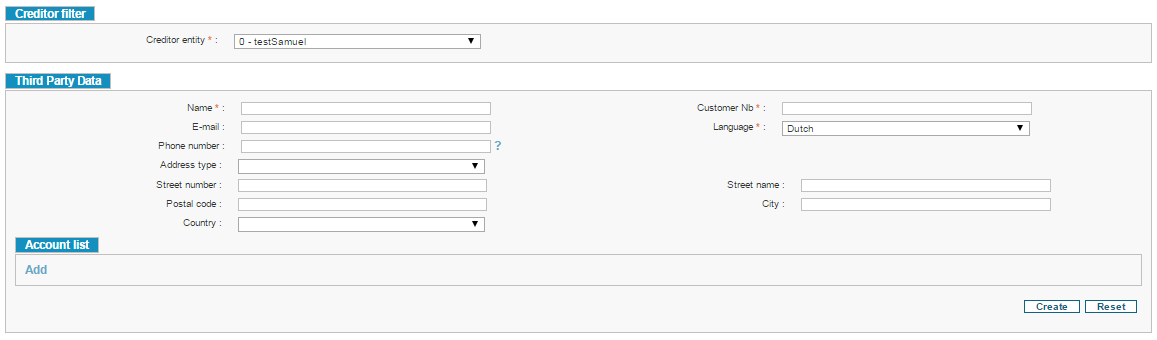

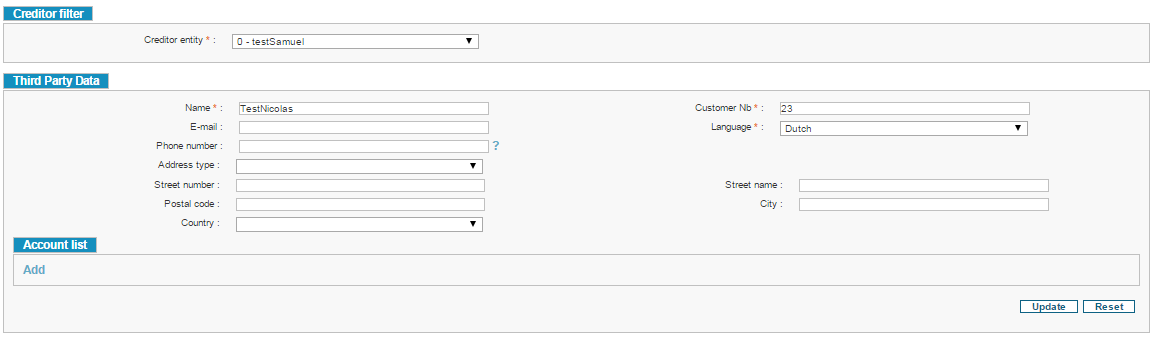

Creating a Third Party

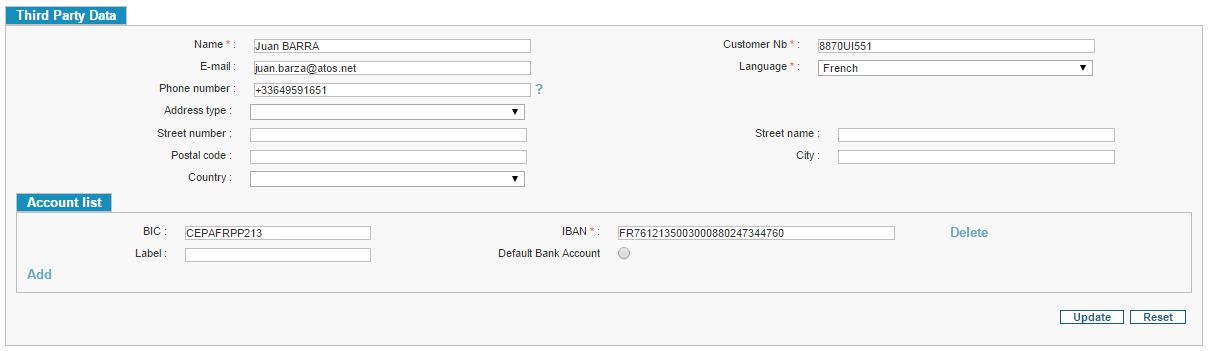

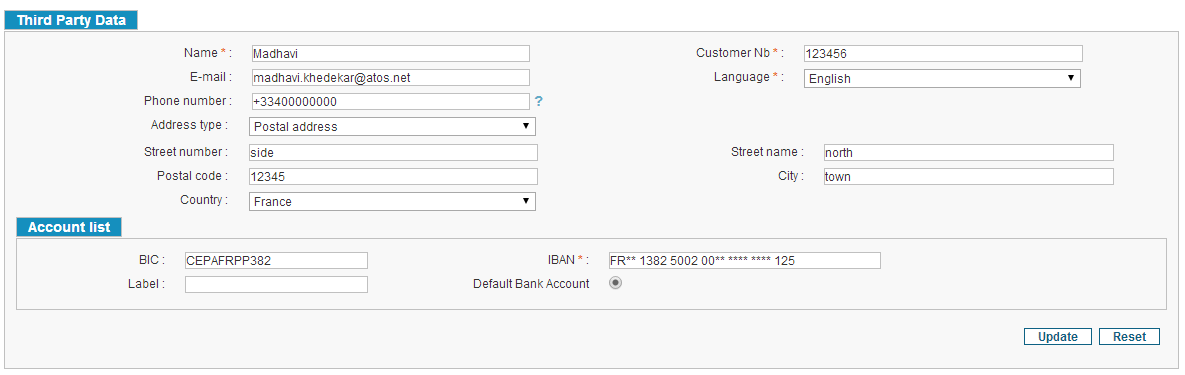

A third party is identified in SPS by a customer number (“Customer nb”). All third parties are associated to the root of the creditor organization. An unlimited number of bank accounts can be linked to the third party.

To create a third party, the user must browse to Home > Creditor > Third Party Management: New third party.

The third party’s name, customer number and language are required fields when creating a new third party. The third party’s language will be used by SPS to decide in which language the notifications will be sent.

The phone number must be input using the international format, and, as such, must begin with a plus sign.

To add a bank account, the user should click [Add].

When all necessary information has been entered, hitting [Create] will create the third party.

Modifying a Third Party

Edit a third party to change his personal data, or add/delete bank accounts linked to his account.

To do so, the user must browse to Home > Creditor > Third party Management > Third party Search, then lookup the desired third party and click on the [Edit] action button on the right of the results table.

Except for the third party’s bank account(s), the updated information is applied to all the mandates linked to the third party. However, updating a mandate will not affect the third party’s account.

On the third party update page, the account IBAN and BIC can be updated only if the user is associated with the profile ‘View Beneficiary IBAN

data’ profile.

If the user is not associated with the profile ‘View Beneficiary IBAN data’, he cannot edit the account (BIC and IBAN). The account IBAN and BIC is displayed as read only field. The user cannot add/delete account.

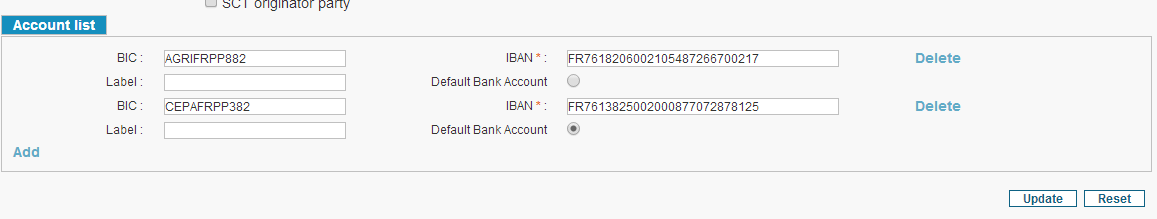

Management of the default Bank account

Adding default bank accounts to third party

On the third party creation/modification pages, the application provides the functionality to choose one bank account as default account, when adding bank accounts for third party.

This is implemented using radio buttons.

If the user doesn’t select the default bank account, the first account will be set as default account.

If the user deletes the default bank account and does not select another one before submitting the form, the first bank account of the list will be assigned as the default one.

It is not possible to set several times the same Bank account. If the user tries the message “Account [BIC/IBAN] appears multiple times” is displayed when trying to submit the form.